This idea is predicated on the assumption that it is more difficult or even impossible for Cash App / Venmo to initiate a chargeback if all funds have been moved to the backing bank account. The problem is that we do not actually know if this is the case. If you have expertise in how and when chargebacks can happen from payment processors like Cash App and Venmo to backing bank accounts, please share your knowledge with us.

Hi folks - I’m the “lucky” seller from that linked post describing how I got robbed (multiple times) via the Venmo and Cashapp payment methods.

Wanted to share some more insights re: what happens to your money in your payment method accounts & bank accounts on the victim’s side once these chargebacks happen…

TL/DR - if your money is “in flight” (transferring to your bank account) it’ll get brought back. And even if your money makes it to your bank account, it’s still not safe and can be clawed back.

In the Venmo case, I had amassed proceeds from a few settled Bisq sell transactions - $1,200 worth total balance in my Venmo account. I wanted to cash that out back to my checking account, so I initiated a transfer. Said it’d take 2-3 days. No problem, or so I thought. Nope, The next day (before the transfer to my bank had completed), the Bisq buyer (scammer) initiated a chargeback via their bank, who then passed it on to Venmo, who then cancelled the transfer and froze my account. That’s the last I ever saw of that $1200. It never made it out of Venmo.

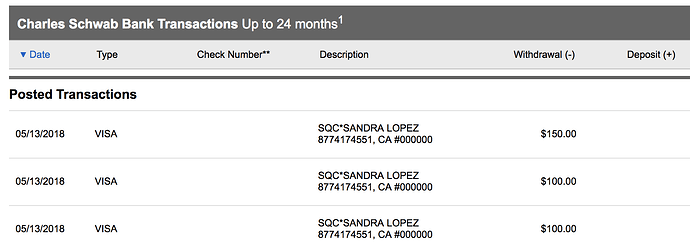

The CashApp case is more frustrating. I had about $300 balance in my CashApp + debit card account. The scammer initiated chargebacks for $650 worth of transactions against me. You’d think that the most they’d be able to steal back from me was $300, right? Nope. CashApp drained the balance of my account, and then went even further and pulled the remaining amount out of my checking account! Holy crap. See attached, screenshot of my checking account history. (“Sandra Lopez” is listed in my original post as one of the buyers that popped me with chargebacks.)

So right now my CashApp balance has been drained, my account appears to be frozen (I can’t add more funds, delete my bank account, etc.) and there’s apparently no way I can stop future chargebacks from reaching all the way into my checking account to claw back money. I’m waiting to hear from CashApp support team, but I’m also going to contact my bank and ask if they can block all activity from Cash / Square at least for now.

Pain in the ass. Not life-altering financially thank goodness, but certainly annoying. In the meantime, I’m mentally preparing / bracing myself for more chargebacks from the OTHER Bisq transactions I’ve done over the past 6 weeks, for all I know more are coming. Wheee!