This is not correct: The BTC buyer pays the higher security deposit and the reason is that he might just not send the Fiat if volatility is high and he loses less to not fulfill a trade compared to go on with the trade with the higher price.

That was an issue in earlier versions in time of high volatility, specially with altcoins.

We added the feature of a custom security deposit, so the maker can define the deposit the BTC buyer need to pay. Default is 0.03 BTC which was about 75 USD @price 2500 USD. Now it is a bit too high but the maker can use lower (0.001 is min.).

The deposit for the seller is fixed and lower as there are very low risk that the seller does not release the BTC at the end of the trade (leads to arbitration and risk to lost his deposit - but he cannot cancel the trade).

If you compare Bisq with centralized exchanges like Gdax where you have zero privacy and a completely different model from all possible aspects, you either don’t understand Bisq or don’t care about those aspects (privacy protection, open source, not custodial, security, community driven,…).

Take a bit of time to read the whitepaper and get a better picture what the project is about and then decide if that is something relevant for you. If the fee is the most relevant aspect you will get served better elsewhere.

Is matter and I understand Bisq and I like Bisq to earn more profit then now, not per trade or volume but per year. And the fee matter.

And how do you think software like Bisq gets created? Grown on trees?

No it’s the work of high skilled developers who could earn a lot of money if working for any BTC company but who have decided to invest their energy and time in that project because they belief that this is relevant for reasons outside of purely monetary incentives. In my case I have worked 3,5 years with 60-80 hours/week on Bisq and spent a considerable amount on expenses and the return on fees is rather negligible so far.

Hearing then people complaining like you do makes me feel a bit sick to be honest…

Ok, sure the fee matters and we will adjust it in the next version with the changed BTC price. The 0.2% fee as it was when we release the last version is IMO not too high compared to exchanges in our field and with the nature of Bisq which is missing on all others (privacy,…). The fee will also be decided in future by voting in the DAO. So any stakeholder will be able to influence it.

No, I do not. How do you think that software like Gdax gets created?

OK - then I will lock off - I do not get any money for my time… I hope Bisq find a way to get higher volume and on that way more profit. The risk is that a clone of bisq go online where the focus is high volume.

It is 0.2% only if the distance is 1% as as I’ve spent a lot of time explaining several times.

Yes, here:

https://www.coindesk.com/bucks-to-bitcoin-top-exchange-platform-fees-compared/

Fees are up to a maximum of 0.5%, depending on the order type and other factors.

And you can see here the fees for withdrawing and depositing money. Very wild.

As said I agree that with the recent BTC price rise the fee is higher as planned.

0.2% was the target, using that it would result in a fee of 0.6% for an offer with 9% market distance. So if you earn 9% from a trade you lose 0.6% of it on fees. But even with current price of about 4000 USD it is 3*0.32%=0.96%. So you earn 8.04 % instead of 9%.

Do you really consider that a problem?

Offers with a large distance to market price are usually not taken and stick long on the offerbook creating load for the P2P network. A centralized exchange does not has those costs as it is a simple database.

You have to think different in context of a P2P exchange. Costs are costs for all users, the infrastructure is a common good and you need to protect that against over-use and abuse (spam).

Your first link is from 2015.

The 2.th link have no date but the youtube video if from the beginning of 2016.

How is it today?

I hope my link https://www.itbit.com/fees is updated.

I am not sure I understand you formal. Here is my formal. Maker 1 btc, marked price 4000 usd 9 % market distance = 4360 usd.

0.6% of 4360 = 26.16 usd more then 0% maker fee.

Do I really consider that a problem?

Yes, I think it limit the volume in Bisq because at top is extra external cost.

Do I think that users like to pay 26.16 usd for “privacy protection, open source, not custodial, security, community driven,…”?

Only fee will pay 26 usd so it is important to reduce the fee. If a fee reduction to 8 usd make 4 times more trade then bisq get 4*8 usd = 32 usd and 32 usd is more profit then 26 usd + the taker profit.

Good point. How many event (Create offer, take offer, cancel offer, cancel take offer etc) can Bisq manage per second?

The more nodes that are connected to a P2P network, the better their operation.

Thus, when nodes arrive and share their own resources, the total resources of the system increase.

This is different in a server-client mode architecture with a fixed system of servers, in which the addition of clients could mean slower data transfer for all users, as is the case, without exception, of all exchanges Centralized.

Remember the very serious problems of congestion that Poloniex has and the restlessness of its users.

On the other hand you have lots of exchanges with fees brutally superior to Bisq, your assumption that the moderate rates of Bisq can be cause of low activity do not correspond to that which can be seen in the bitcoin ecosystem. You can see these rates: 3% by SEPA and above. https://paybis.com/rates

And relied more on the press analysis than on the neon ad at the door of the den.

I find you tecknical imput interesting.

I have never heard about paybis.com (Russian) and I think that they have a low volume because of the high fee. Do you know how many % of the total btc trade volume paybis perform? Why compare Bisq with something from Russian. I think Bisq is more.

I mostly focus on The Best Bitcoin Exchanges when I select my crypto coin shop.

But never mind, I am only one user - try to ask many users if the total fee do that the trade off or anti bisq. And try to analyse if lower fee make MORE profit. And more P2P connection.

Another advantage associated with P2P networks is that they can take better advantage of the use of available bandwidth between users for file sharing, So you get better performance and performance on the connections.

With my examples, which I have given enough, I just want to make clear that a fee around 0.5% can not prevent an exchange take a considerable market volume.

I’ll give you another one:

Note the deposit fees for transfer 5% (!) And trading between 0.2% and 0.5%

https://www.quadrigacx.com/account-funding-withdrawal

This exchange has a monthly volume of 702,955.45 much higher than Bisq

The volume problem of Bisq is simply marketing, no fees

How do you do? 5%?

Funding Options

Bank Wire Free

Withdrawal Options

Bank Wire Free

Do you have a link to:

trading between 0.2% and 0.5%

The 5% fee for Electronic Funds Transfer is businesses langues and say: yes, we have this option because one customer was ask for it, but don’t use it.

That is true for DHT systems but we use a floodfill network (like Bitcoin) and that works different. Here the messages get flooded to the network which is very resilient and robust but has limits in the number of messages. The number of nodes is here not really relevant. The network can work well with the number of offers we expect, but if there would be too many offers the network would create a lot of load for each node and create congestion. Offers which are close to the market prices will usually be taken quickly so they cause not a lot of network load. But offers which are sticking around for weeks or months because of a not attractive prices will create network traffic but does not really provide much value (beside to let the offerbook look more filled up).

That is the reason why we want to de-incentivize offers with a high % distance to market price to reflect the cost/benefit relation.

I think I understand, the floddfill algorithm will take longer to fill each node if there are many bids.

I do not know the data that goes in in mesaje of the offer that goes to the network, but would it serve as something that would only send the basic data of the offer, and that when taking the offer download the complete message from its node?

A flood fill network works that way:

You are connected to a random group of peers in the p2p network (8-12 peers) and if you broadcasts a message to the network (like a offer message) you send it to your connected peers. Each peer sends it again to their connected peers. If you receive the same message you sent or you have already received from any peer you do not broadcast it anymore to other peers (otherwise it would go endless). Floodfill networks are very robust because they have a high level of redundancy and they are very difficult to censor (in contracts in a DHT network it is easy yo sybil attack nodes so they don’t see all the data).

The downside is the limitations in network throughput because each message creates some level of activity for the network. Bisq was tested with about 1000 offers and worked fine, but it will not scale up to 10000 offers because the incoming and outgoing messages would create congestions.

A offer need to refresh itself every few minutes because it can be that the maker loses internet connection without a planned shutdown/removal of the offer and to avoid that dead offers are tangling in the offer book each offer has a short time-to-life of about 4 minutes. If a maker does not sent a refresh message before the TTL triggers the other peers remove that outdated offer and thus managing to clean up their offerbook from offers which are not online anymore.

I agree. By my calculations, the exchange fee (excluding miners/transfer) is 5%. Once again, I don’t include any other fees, just the fee to the exchange. LocalBitcoins charges 1%. Bisq is a wonderful platform. P2P concept is fantastic. However, the high fees impede many transactions. That’s why you see little activity. The business model must be changed and the fees reduced to 1%. Then you get more trades, more participants, larger volumes. Otherwise, business goes to the competitor.

How do you come to 5%? 0.2% is the fee for a 1 BTC trade with 1% distance to market price. The security deposit is not a fee! You get that refunded when the trade has completed!

There is some case where high percentages can be given over the amount of trade.

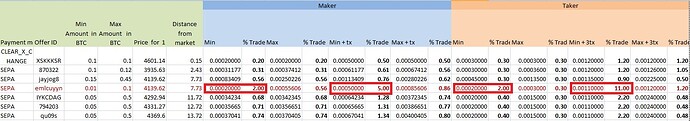

If the amount is very small, mining rates represent a high percentage of the total. The minimum of Bisq’s fees is also applied, all of which leads to raising the percentage. Can be seen in the offer in red.

I have used these formulas

Maker fee = Max (0.0002,0.002 * Amount * SQRT (distance)) + Tx

Taker fee = Max (0.0002,0.003 * Amount) + (3 * Tx)

(Tx = 0.0003)

When the amount is very small, and also the distance to the market price is somewhat high (7.73%), the maker will pay 2% (5% with mining fees) and taker 2% (11% with mining fees)

Perhaps this circumstance explains some queries about this. When the distance is below those values and the amount is at least 0.1 the rates will be around 0.3% (0.6% with mining rates) for the maker and 0.3% (1.2% with mining rates)