So, we keep getting about one dispute a day regarding clearXchange (cXc). Their business terms aren’t clear and we’re still figuring out what we can do to reduce the bad user experience and workload for arbitration.

At the moment it seems that txs always work when one of the two trade partners has an account with one of the following banks:

- Bank of America

- Chase

- US Bank

Possible fix:

Make sure in the client that one trader has an account with one of the three banks. If you don’t have one of these, offers from other people without account are greyed-out and can’t be taken.

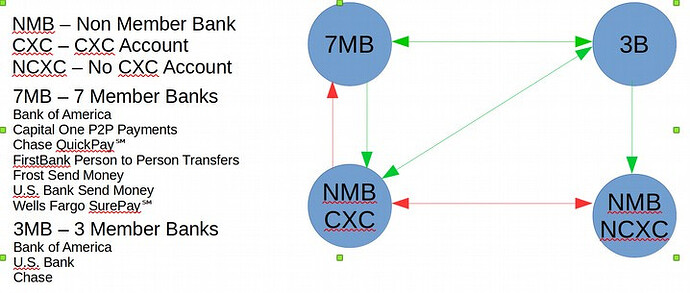

I made an ugly visualization of what should be possible and what not ![]()

Is it safe to say that EVERY user that wants to use cXc MUST have an account at cXc, to rule out all kind of dispute cases involving non-cXc users? Additionally they must have finished the verification process at cXc and their bank before accepting a trade. In >the settings and there’s just a small link next to the bank account settings that one has to select to begin the process

I’m adding to this post later as I have to run now.

Please provide your experience and point out errors in this summary. I think cXc is a good fit for Bitsquare/bisq when we can make this work.

Thanks to @nrwd2vcvv @ddawson @Earthlark @jkepler and everyone else who gave input already.