See: https://github.com/bitsquare/bitsquare/issues/500

Would be great if anyone can extract the info required to add it to Bitsquare.

What I get from a quick look is that one needs only the recipients email!

And its basically a bank transfer between institutions that use that system.

Thanks for having a look to it.

Does it fulfill our requirements?

- Arbitrator can verify transfer via a https webpage where the user can proof his transfer

- Low chargeback risk

The transfer is initiated within a participating institutions online banking application -> https webpage or mobile phone application

charge back risk -> requested the info

(actually the service works also with mobile phone numbers, not landline!)

The chargeback risk seems to be low according to this auctioneer association’s website:

http://www.albertaauctioneers.com/articles/view/19-interac_etransfer_the_canadian_way_to_get_paid_securely_online

regarding chargeback risk:

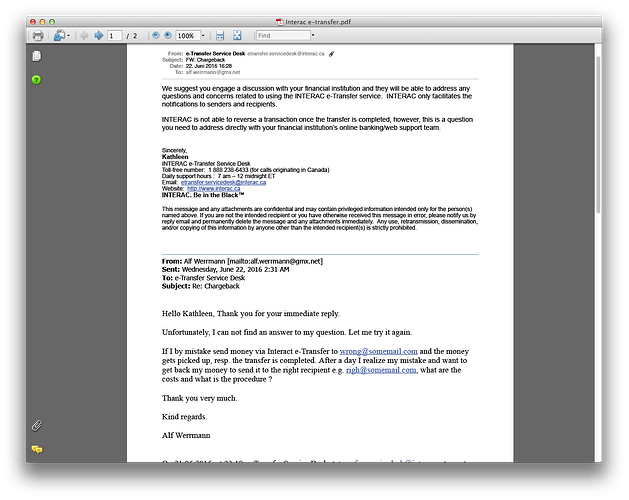

"We suggest you engage a discussion with your financial institution and they will be able to address any questions and concerns related to using the INTERAC e-Transfer service. INTERAC only facilitates the notifications to senders and recipients.

INTERAC is not able to reverse a transaction once the transfer is completed, however, this is a question you need to address directly with your financial institution’s online banking/web support team."

Great thanks! So seems the chargeback risk is the one of the banks.

I checked some video tutorials and it seems it only requires:

name, email and tel. nr. as well as a secret question + answer. As far I understand we could use the trade id as the answer, so the recipient can accept the payment.

Fees seem to be free as long it is in the systme, though depositing is not very cheap (4 usd) and takes 6 days.

Not sure if I can make it to the next release, there is still much other stuff to do and I don’t want to postpone it longer as to the weekend.

Good question and a clarifying reply.

It needs email OR mobile nr. only! (So the recipient gets informed that there is money within Interac e-transfer to pick up)

Secret question + answer, is for the senders security that noone access his online/mobile banking. Bitsquare does not need it as I understand it.

Its expensive only if one accepts this payment method while his bank is not!! As usual the user needs to inform himself first.

Is there a way to avoid the MITM attack? https://github.com/bitsquare/bitsquare/issues/373

Can the user see some informations to understand if the sender is the one that made the offer on the Bitsquare and not someone else?

As far I understood they use that question/answer method to be sure the sender knows the receiver, which sounds like a good solution to prevent MITM. I had not thought about all and did nto had time to investigate more, but so far it sounds good to me.

Btw. I will add to the trade process to the next version a few info (display name and tell that user only confirm receipt when all matches). Still not the full version with extended ref. text but stronger.

Not sure what the policy here is on thread rez; has there been any progress on Interac EMTs in Canada? This is currently the most popular digital person-to-person transfer method in Canada.

I would love to add that but there are still information missing. Specially if the secrete question is required. If so it takes a bit of extra work to integrate it.

i would like to see this feature added, ManfredKarrer is there anything i can do to help you integrate it?

i dont have any coding skills

has the nickname EMT for email money transfer or e-Transfer

the secret question is required and its the only way for a user to complete the process of accepting the funds that were sent.

a name is also required.

if the user gives the sender the wrong email address and a cancellation is required some Canadian banks charge a $5 fee to cancel the transaction.

references -

sorry for the pastebin but i couldn’t post more than 2 links

Thanks a lot for your input!

For me it is still not clear how the process with the security question and answer can be applied.

It assumes that the sender knows the receiver personally and use some private information for that (whats the name of your wife,…). But in Bitsquare the traders have no personal relationship so what could we use here. The trade ID should work, or is there any restriction int he tyle of questions?

not sure if there’s any stigmas about talking about LBC, but normally the BTC seller inputs his coins into the escrow then the interact sender sends the interact transfer to the email the buyer provided, seller then provides the answer to the question.

there is no restriction on the question types, but once you send a transfer the first time it likes to reuse the same question/answer for the next transaction you might share with the same email.

i am not sure if that’s a bank specific type of feature or if its across all interact email transfers

forgot to mention that though a name is required, they can be fictional names not attached to bank account itself

Ok. If it might stick over transactions its better to use a fixed Q/A what people are setting up in their account.

So for instance:

Fiat receiver set up his account with those data:

name: alice

email: alice@gmail.com

Secrete question: My dogs name

Answer: Bunny

Fiat sender set up his account with those data:

name: bob

email: bob@gmail.com

Secrete question: My cats name

Answer: Mia

When Fiat sender has to send the fait he get displayed the question of alice (My dogs name) to use in the Interact transfer form.

When Fiat receiver get the fait she see the question (My dogs name) and reply in Interact with Bunny.

Do you think that works correctly that way?

Is there anything else needed beside name, email and q+a?

that works correctly, nothing else is needed.

although there has sometimes been delays in the emails being sent

it has only been a 3 hours maximum from what ive encountered so its been fairly instant at times

Ok, will see if I can squeeze it into the upcoming release.