There are few subtilities which are difficult to see for new traders on Bisq. I want to give here a few hints and background information to help to make your offers more accessible for takers.

Consider that takers pay the miner fee for the deposit and payout transaction

The taker need to pay the miner fee for both the deposit and payout transaction (as well as his taker fee tx) the costs of the miner fee can become a big factor especially for smaller trade amounts.

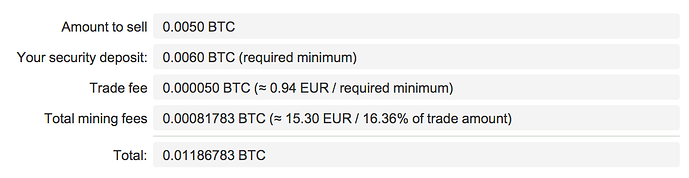

I just took a screenshot when trying to take a 94 EUR offer at fee rate 121 sat/vB:

As one can see paying 15 EUR on miner fees for taking a 94 EUR offer is probably a barrier for many potential takers.

Beside that the taker also pay a higher trade fee (7 times the fee of the maker, but as you see in the example the trade fee is likely not the problematic factor). For higher amounts like 2 BTC trades the taker fee will play a more influencial factor.

So what can a maker do to attract potential takers?

Wait for lower miner fee rates

When fee rate goes down (e.g. to 20 sat/vB) those costs on miner fee will also go down. In our example it would be about 2.40 EUR which is likely not a barrier anymore for most takers. On weekends the miner fee often goes down, but of course it is unpredictable and not great to be limited to a few days…

Increase trade amount if possible

The catch here is the “if possible” as many users are new traders who have not got lifted their account limits and are stuck with the 0.01 BTC limit. And specially those who hope to get signed might wait very longer in times of high miner fees. For takers its is also more risk to take an offer from an unsigned buyer. Those unsinged makers can increase the incentive for takers by offering a lower price.

Switching to other payment methods which do not require account signing (beacuse of lower chargeback risk) is another option. With that trade amounts for 0.25 BTC are possible even for first time buyers (sellers do not have limits anyway).

Use a lower trade price (e.g. negative percentage)

In our case above if the offer would cost only about 80 EUR the taker would get his costs covered by the better trade price. Though a -15% price tag feels very high, but I think we get caught here by a psychological trap. It is about the total costs. The taker will not eat those 15% but it goes to Bitcoin miners. That’s the price of the decentralized money system. [1]

Be a taker

Of course you can take yourself an offer and pay the higher miner fees.

Restricted bank account countries in SEPA account restricts your trade opportunities

If you have setup a SEPA account, be aware that when you limit the accepted countries it might reduce a lot your trading opportunities. You reduce it basically from traders from all EUR countries to the ones from the county(ies) you have selected.

This can be intended if you want to avoid bank fees for transactiong with foreign banks (some banks in some countries seems to do that) or for other reasons…

I just wanted to point out that an offer which can be taken only by a small subset of potential takers will have it harder to find a taker.

Set up SEPA and SEPA Instant account at the same time

If you set up a SEPA account consider to also add a SEPA Instant account to enjoy account aging. Otherewise if you want to set it up later the account is considered new.

With a SEPA Instant account any SEPA offer can be taken as well, the other direction is not permitted.

Use TransferWise

See: TransferWise is the perfect fit for Bisq

[1] Note to problem with hight miner fees:

We know that second layer solutions like Lightning Network would be great to get around that problem and Bisq developers have started to look into options but so far no technical and conceptual feasible solution was found. In short Bisq requires MultiSig capabilities and LN does not have that feature.