I’m not sure if the topic chosen above is the right one or not but here’s my thinking. I’m very interested in Bitsquare and would be interested in buying coins for US Dollars. However, it isn’t easy/cheap for me to do a ‘national bank transfer’ in the loosest sense. I would however be interested in purchasing coin from a seller that can accept payment via clearXchange. clearXchange just requires an email or mobile number, but only certain banks are members (Chase, Bank of America, CapitalOne, FirstBank, US Bank, and Wells Fargo, perhaps others). It would be great to see such offers, otherwise I’m not willing to accept a bitcoin seller’s offer if it only specifies “national bank transfer” because I don’t want to end up having to do a wire transfer.

Do you know hwo the chargeback risk of at clearXchange?

What are the fees and how long does a transfer take?

Would be great to get a better payment method for US as banks there are terrible…

@Marc: Do you have time to investigate?

I’ll investigate.

Doesn’t look good. Transfers go through ACH network which has a high chargeback risk. It seems that you can’t chargeback on the clearXchange platform, but I have the suspicion that you can reverse the transfer by calling your bank.

What do you know/think @BlueCustard?

Edit: I added clearXchange to the pament methods spreadsheet.

Well, unfortunately I can’t add anything. I’ve used the service through my bank and it doesn’t have any facility through the web interface to reverse a payment. Also I went through the service agreement from my bank and it doesn’t mention any way of reversing payments. It certainly has the nice feature of being free, at least my bank provides free transactions through the system, and from what other people have written transactions through it carry no fee on Wells Fargo too. Given that the 3 largest banks in the US participate it seems like it would be a go-to method for transfer there since the alternative, a wire transfer, can be like $25 or more.

Just to throw my own opinion/guess in there I would actually doubt that banks participating in the network would allow chargebacks. ACH transfers can be initiated by the party receiving funds, but clearXchange transactions can’t, at least not that I can tell.

Thanks for your info. Could you request from your bank info regarding chargeback?

Another question? When doing ACH or WIRE do you use the same bank account data or is there anything what distinguishes them? Currently people can do ACH but I need to deactivate that as it is too risky.

WIRE on the other hand does not make much sense as it is too expensive (as well as international transfer). So that would lead that we don’t have any usable bank transfers for US, leaving only PerfectMoney, what is of course a very unpleasant situation.

Cash deposit is the next candidate but still needs someone to collect all the info and it will not serve those people who want to do it online.

There are several bank specific payment methods I saw on LBTC but no info yet about those.

So to get the best and safest US payment methods would be a hi-prio task!

If I get the info very soon I might add it to the next release (planned for the next days).

The info I need is the risk for chargeback, costs, duration and the required fields (see forms for payment methods in the app)

Sure, I’d be happy to ask them about chargeback. As to your question about ACH or WIRE I’m not quite sure what you mean, are you asking if I expose the same data? The answer is no, I don’t. In order to send me USD via clearXchange you only need my email address or mobile number. That’s one of the things that’s really attractive about it, in order for you to send money to me I don’t have expose my bank routing number or account number. So… is that what you’re asking? As to costs that’s the best part, my bank charges me nothing for transactions, though they may have a limit per month on the number of transactions and the maximum amount for a transaction isn’t that high, I forget now but I think it’s a few thousand dollars. Would you like me to send you a PDF of my bank’s service agreement? I think answers to much of your questions may be in there.

Oh there’s a link to the Chase agreement here: https://chaseonline.chase.com/Public/Misc/LAContent.aspx?agreementKey=chasenet_la

After further review, I think we can add clearXchange. Here’s the relevant part of the TOS (Section 8):

Money transfers are finally done via ACH but you acknowledge the TOS, which means that after a transfer has been ‘accepted’ (automatically), there’s no way to charge back.

I haven’t found a single case of a successful dispute or chargeback.

You would have to make sure that there is a https://… page at clearXchange that can be audited by an arbitrator, i.e. a single page that shows the transaction has been completed, sender’s info (E-Mail or phone) and receiver’s info.

I think it could work. The only information that can be found about chargebacks by cXc is that they can’t be done. This way we could include some major US banks.

Great to hear, I think this makes sense. According to the user agreement they do imply that you can send a payment to someone with a bank account that isn’t part of their network (and the longer payment times occur under that scenario) but the sender must be sending via clearXchange therefore with their TOS you wouldn’t be able to charge back the payment.

About the https:// page for confirmation, I’ve used the service via Chase bank and they definitely do not have any page that could be accessed without logging into the bank. I’m not sure what to do about this. I’d imagine the bank doesn’t see this as a problem because they are not concerned about providing verifiable 3rd party proof. Perhaps I could ask them about this…

The confirmation via https is only needed in case of a dispute. So if the user can login to his bank account and can see the transaction all is fine.

My question regarding ACH and WIRE was not connected to clearXchange.

Atm we have national bank transfer enabled for US but as people use that for ACH I need to deactivate that. Wire would be more safe but as it is so expensive it is irrelevant as well.

I will deactivate national bank transfers for US and add clearXchange and cash deposit.

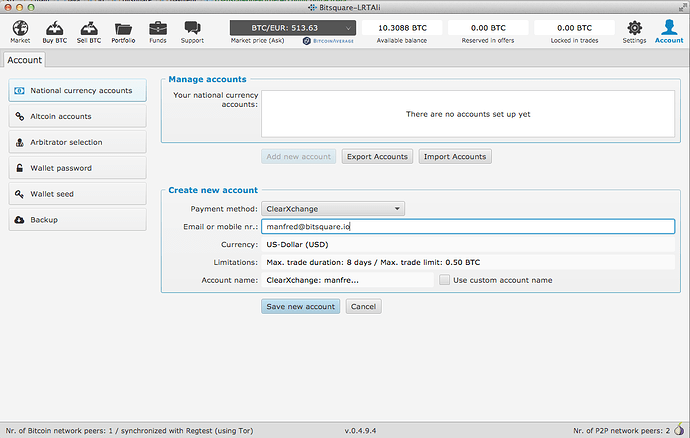

Can you confirm that “mobile nr. or email” is sufficient to do a clearXchange transfer:

So the only fields at the account setup would be “Mobile Nr. or email:”.

I set the limit to 8 days.

Not sure if i set the trade amount to 1 BTC or less (at it is new and we don’t have experience with it yet).

Yes, definitely, transactions don’t just show up as a simple line-item in your list of transactions, there’s a specific area where you can see quickpay transactions. If anyone else out there has a bank account in USA with a clearXchange member bank I’d love to do a transaction, buy or sell, at last trade price just to put it through the paces. Fortunately 4 of the top 5 banks in the US–with the notable exception of citibank–are member. According to this article all the major bank members offer clearXchange transactions with no fee. Apparently US Bank used to charge 6.95 but they dropped the charge in July. You can see the article here:

http://bankinnovation.net/2016/07/u-s-bank-removes-fees-for-instant-payments/

Thanks for the info. You can install the pre-release dev test version at http://bitsquare.io/download/dev-test.

Would be great if we could do a test trade before official release to see if all is ok.

Any other US citizen out here who might partizipate in a test trade?

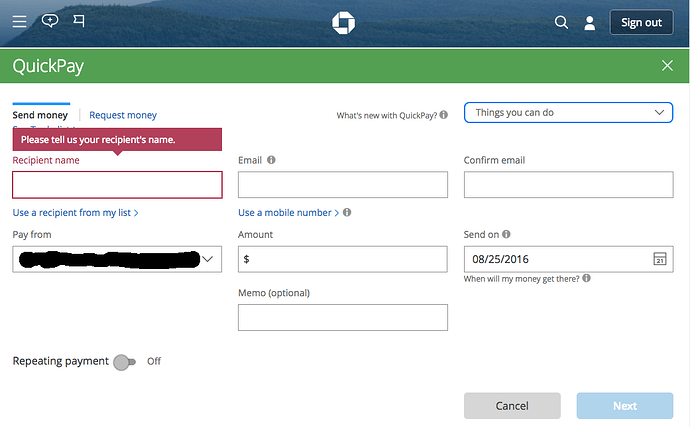

Telling from the screenshot, it seems that you need to know the recipients name as well. Can you please confirm/deny.

Changed download link to http://www.nucleo.io/download/dev-test/ as we moved the bitsquare server and directory access is not allowed there.